Man, remember in college when your biggest concerns were trying to avoid scheduling Friday classes and praying your girlfriend wasn’t pregnant? Yeah, well, those days are over and now our lives are filled with trying to make ends meet between entry-level jobs and crippling student loans.

Well, now Goldman Sachs is telling us that all of the aforementioned concerns could be avoided by just skipping college altogether. Per AOL:

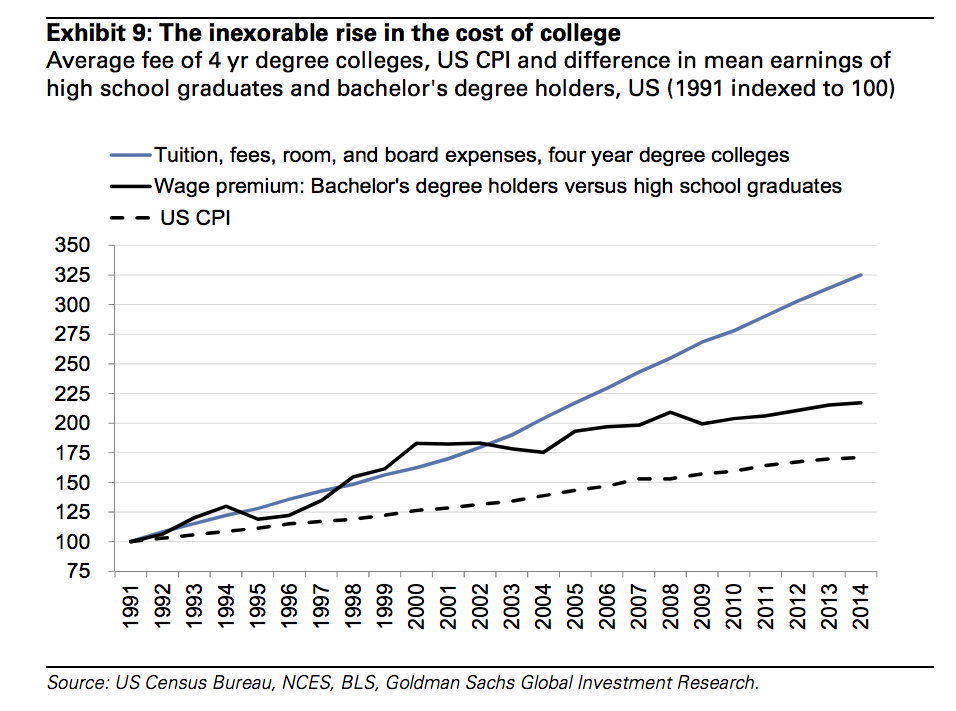

“For the typical student the number of years to break even on the cost of college has grown from eight years in 2010 to nine years today. If current cost and wage growth trends persist then students starting college in 2030/2050 will have to wait 11/15 years post college to break even. 18-year-olds starting college in 2030 with no scholarship or grants will only start making a positive return when they turn 37,” Goldman’s Hugo Scott-Gall wrote.

Tulane put out a chart explaining the rise in tuition versus the wage premium, and it made me feel super uncomfortable for the generations ahead of us.

Well, this is awkward. Sure, maybe tuitions wouldn’t be skyrocketing if every school wasn’t in an arms race to have the best facilities for their B-School, but who am I to criticize the decision-making of a bunch of bigwigs who run schools like Fortune 500 companies rather than institutions of higher learning? Some say, “Greed is good,” am I right?

Luckily for me, my kid is just going to get a D1 scholly and graduate with no debt before making millions through endorsement deals driven by the twelve Super Bowls he brings to the Detroit Lions. .

[via AOL]

Image via Shutterstock

Not sure what is more delusional, Goldman Sachs hiring someone without a college degree, or the Lions winning the Super Bowl.

I mean it’s pretty simple logic, if you aren’t going to get a degree in something that will allow you to pay off your debt, then why are you going?

There are plenty of jobs that don’t require a degree, like welding, where you can make over 6 figures a year with no college education.

Or join the Army for 4 years, and then go to college on the government’s dime.

This might not be a popular opinion here, but I just really don’t have sympathy for people who took out loans and can’t afford to pay them back now.

I have a buddy from high school who makes a killing as an electrician. Even when he was an apprentice he still made like $12/ hour. Trades are always in high demand and certainly nothing to look down on.

No kidding, there was something on NPR the other day about lineworkers making $50+ an hour with INSANE overtime during bad weather, great benefits, and a healthy pension. Apparently they cannot fill these jobs fast enough-everyone is still obsessing over college degrees for simply the cache without thinking about if it is truly their right and best path.

I used to work for a utility, I can confirm. My boss told me that a hurricane hitting the south or a blizzard in the Midwest basically meant a new car for the linemen. They’d get sent to help in another state, get paid every hour they’re away from home, plus every hour they’re working, plus overtime, and end up pulling 40 hours per day.

Caroline, I misinterpreted your bit about lineworkers, thinking you meant assembly line workers. Didn’t think power lines.

I would love to be all positive about NPR’s lineworker claims but I’d have to see where they got their data from. The truth is that US manufacturing has declined 29% from 1997 to 2015, nearly 5 million lost manufacturing positions, according to the US Bureau of Labor Statistics; this even takes into account the ~865k manufacturing jobs that have been added since the low in 2010. Since 2000, 17 major car manufacturing plants have closed in the US. My step-father lost his job when Ford’s Norfolk Assembly Plant closed in 2007. Thankfully, he was also a certified electrician so was able to find another job quickly.

In a report published yesterday, we’re expected to lose 85k mining jobs in coal and copper alone over the next few years from ONE company, Anglo American. It’s tough out there, folks.

The military isn’t the answer either. I did ROTC and had my education paid for and now I’m in the private sector so it worked out for me, but the truth is that the military is cutting thousands of officer positions like mine over the next few years as well as tens of thousands of enlisted positions which would qualify for the GI Bill.

The bottom line is we can’t say that looking to manufacturing or trade jobs is the answer and to forego education. And avenues to pay for education, like the military, won’t always be available. The reason education is spiraling out of control is because people are taking out more loans to pursue careers that won’t pay off. According to the US Census Bureau, over 14.2% of all bachelors degrees in 2009 were in literature and languages, liberal arts and history, and visual and performing arts. Another 4.6% of bachelors degrees were in PSYCHOLOGY alone! This doesn’t even include degrees like sociology and anthropology.

We need to refocus our educational efforts. True, not everyone needs or deserves higher education, but nor can everyone work in a trade. Do we need to expand our vocational school efforts? Absolutely. But as our manufacturing and trade jobs disappear, as they do from time to time, we need to educate more people in college in subjects that will actually pay off.

“Another 4.6% of bachelors degrees were in PSYCHOLOGY alone!”

As someone who got a psych degree and now has a cushy job in marketing, I’m not sure why this has your panties in such a twist. Maybe we shouldn’t be treating higher education like vocational training and allow for it to help develop critical problem-solving and exposure to different schools of thought?

It’s really frustrating when you have to explain what your degree taught you just because it wasn’t in business, engineering, or the medical field. I graduated with a degree in political science, had an internship in marketing consulting, and I got a job in sales.

They key is to go into work for yourself as a tradesmen. You’re only billing at $50-$90 an hour (at least around my area) so if you are just working for someone, you won’t see a ceiling much more than $25/hr realistically. Unless you’re part of a union of course. The old man is a Master Electrician and has done well for himself.

Obviously pipeline welder’s are in a bracket of their own. But then again, it is the O&G industry…

Was so pissed going into my first safety gig for a pipeline company out of college after I found out the welder’s rates and rig pay.

I agree, there are also many professions out there where I wouldn’t trust that individual unless they did have a degree (doctor probably the biggest example).

I think parents need to pay a bigger role though when little Kale says he wants to be an art major, he is aware of the job market and career path for people with degrees in that subject.

I agree with everything here except the last part. While I was in college (08-13) tuition went from $6,720 a year to $11,386. Practically doubling while I was in school. I was lucky to be able to take loans (I guess) but knew friends who had to leave college because the rug had been taken out from them and they couldn’t afford it.

However, these days people getting admitted to colleges know the costs and how much prices can jump. So it is their fault entirely if they pick a dumb major that won’t lead to anything productive.

I’m currently getting my Master’s on the GI Bill, so I’m getting a kick out of this.

But really, the numbers are all about your return on investment. I’ve got friends who went to top schools and paid out the ass, got degrees in terrible fields, and are struggling to get by with 6 figure debt. Be smart with your choices. Figure out your job prospects BEFORE you’re underwater. I got my bachelor’s in something relatively useless, realized it pretty quick, and after my last deployment I went straight to get my MBA. It’s about that sweet, sweet ROI.

This is my plan exactly. Definitely getting my MBA, but it’s kind of upsetting to see a level of debt like this. There are a lot of issues with the education system and how much students are expected to pay. If you don’t want to work in a trade and don’t have parents to pay for college, you have to take out loans. These numbers scare me because it might just be unrealistic for a lot of future people to go to college. For the life of me I don’t see why we can’t heavily subsidize the cost of college. If we cut back on the national budget 8%, we could afford to send almost all eligible students to college for free. It’s scary because the largest amount of personal debt is going to be student loans, which will surpass fucking mortgages.

Exactly! I have been saying this for years.

I’m an accountant doing payroll at a large construction project and it is amazing what money craft/skilled workers make. We have several electricians and welders making $70-90 a hour. Crane operators making $150-175 a hour so yeah they make my accounting degree look like shit.

How much the safety guys makin on that job?

Spot on. Syndicated columnist Walter Williams has a column out today that really fleshes this issue out nicely.

And since we are giving examples of people who didn’t go to college: Buddy of mine has a junior college welding certificate. When he was 19 or so, took out a loan for a bulldozer and a truck. Fast forward a number of years, he own a railroad contracting and excavation company, makes 700-880k annually (not a typo) at age 36, lives in an absolute castle he built himself, wife has big boobs. Does whatever the fuck he wants, is fat dirty, and wears blue jeans, will retire before anybody else he knows, and doesn’t give a fuck that he’s fat, dirty, and wears blue jeans.

Our society needs to push more fringe college candidates into trades and skills instead of a lot of worthless degrees.

Mike Rowe started a foundation to get kids to start going to trade schools. Pretty sure he gives out scholarships. Kind of wondering if I am eligible for one.

1. Supply and demand says college tuition can’t keep increasing at the current rate, because then only the 0.1% could afford it, and there are way more seats available than that. At some point there’s a correction/price stagnation. I figure if I can save up enough to pay for school at today’s prices over the next 10-15 years (say $120-150k), market appreciation takes care of the rest. Mathematically it basically has to.

2. 100% on board with the “college isn’t for everyone, trades are a great option” thing, BUT know what you’re getting into. First, there’s little to no upside in most trades, no “started from the bottom now we here” unless you decide to own your own business, which is a whole ‘nother can of worms (but great if you can do it. Second, at some point you can’t do manual labor anymore. I’m a finance dweeb, I can work as long as someone will pay me to warm a seat and manipulate pivot tables, but most guys can’t be doing manual labor past 50/55. That $50/hr looks pretty good until you realize you need to save a huge chunk of it to be solvent from 55 to dead, unlike office schmucks like me who can plan to work indefinitely if we want to.

Good points, but I don’t want to work past 55 or so anyway, quite frankly. Not saying i’ll necessarily get there

I think the real problem with the cost of college is that the loans are all backed, and even if you declare bankruptcy, you still owe them. So why wouldn’t they write you a $200,000 check to major in Russian Literature from 1865-1867?

Because at some point the default rate is high enough and there are enough ways to “hide” income that they just won’t get paid.

Oh I agree, I think this bubble will eventually pop, I am just talking about the reason for what is currently happening.

As long as the lifelong ROI is still close to a million dollars with a college degree vs not getting one, it’ll still be worthwhile.

Clearly none of you rooks know what the hell you’re talking about. I work in construction, so I do. Those welders and pipe fitters and electricians are out busting their ass everyday putting in ridiculous hours in boiling hot or freezing temps wishing they were sitting in their office with the comfy A/C and ordering people around/browsing the internet. That’s what those with degrees get to walk into instead of climbing up the Apprentice-Journeyman-Master-Whatever ladder for 15 years while ruining your back and doing mindless drone work.

Who said it wasn’t hard? That doesn’t mean it isn’t a good job.

Plus the possibility that something may go very bad very quick. I don’t mind being out in the elements with the hands but ain’t no way could I do the stuff they do.

According to Goldman Sachs I’m already ahead of the curve. Thanks cheap tequila and dollar taco night for helping on that “college thing”

Many brokers don’t have degrees, they’re just salesman pure and simple.

“Now our lives are filled with trying to make ends meet between entry-level jobs and crippling student loans.” I am so so happy and grateful that this is not my life. Oh sure the make ends meet part will always be there but at least I don’t have any debt and I’m not saddle with a depressing entry-level job.