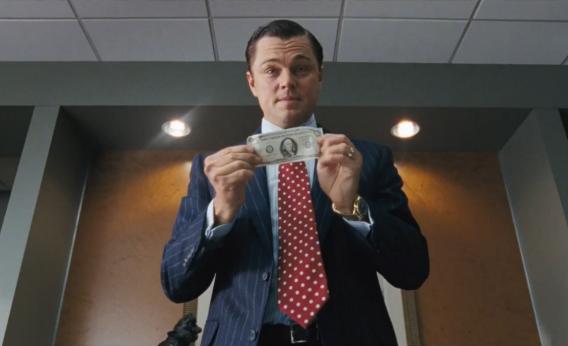

Look at all that money! Still, your newfound financial windfall is not enough to make up for your zero responsibility and total lack of anything that might even remotely resemble fiscal discipline. You are blowing more money on a Thursday afternoon/night happy hour tab than your electric bill. That’s normal because you’re young, but don’t bank on this idea for too long. I know retirement may seem like a long ways off, but shit happens, and it’s not as easy as it seems. Ask the baby boomer generation. Their investments got royally boned by this thing called the “Great Recession.” We all know the 67-year-old secretary named Beth who should retire. Beth can’t retire because she didn’t save enough, got into too much debt, or invested poorly. Don’t be Beth. Here are some basic tips to reduce the odds of you working at a shit job until you die.

Save Money (duh)

Save 10% of every pay check. If 10% sounds crazy, then start with 5%. That’s $5 per $100. That’s not even a cocktail. If you start saving now, it will make your financial life a lot easier. It will also help you develop a small emergency fund to pay for things like flat tires, broken water heaters, hooker abortions and spontaneous trips to Vegas.

Pay Off Your Student Loans

Student loans suck because they remind you of college and how carefree and fun it was. Pay them off as soon as possible. It’s been suggested to pay more than your required amount every month, just so you can brag about it in the office later.

Don’t Abuse Credit Cards

Credit cards are kinda like free money when you use them. When you pay for them they seem like really expensive money. Don’t max out your credit card every month because it kills your credit score. If you must use them, use them very sparingly. Google Dave Ramsey if you need help paying them off.

Spend Cash At The Bar

This sounds useless, but pull out $50 from the ATM for your happy hour before you go. Then only spend that $50. You will be amazed at how much money you save on each trip out, and the odds of you getting blackout and making a fool of yourself go down significantly.

Get A Roommate

Roommates help split expensive costs like water, trash, sewage, gas, electric, and rent. If you are lucky, they will be cool. If you are unlucky, at least you have more money to spend at the bars.

Invest

Once you have savings, don’t just let them sit around, put them in a Roth IRA or individual trade account. It will gain a lot more in a mutual fund than it will in your bank. If your company has a 401(k) then start putting money there too. It’s tax deferred and it comes straight from your paycheck so you don’t even notice it’s gone. If you can start putting money away now, imagine how much even a couple hundred or even a thousand dollars will turn into in 40-50 years.

These all may seem pretty basic, but they will make a difference. No one wants to work forever. Shit, I don’t even wanna work till 5pm. Start helping your future self out. You’ve done enough damage already.

Nothing like working for a firm that matches your 401k contributions.

Free Money?

Yes, please.

Every fiber of my being wants to hate you, but as a guy who works in an equally lucrative and socially despicable field I can’t.

A tip of the hat to you as well

financial consultant? so what kind of insurance are you selling?

If one more fucking “advisor” cold calls me trying to talk me into “investing” whole life insurance I’m going to beat an intern to death with a stapler.

^This

Q:”do you have some time to talk about your financial future”

A:”no, fuck off kid who 1 year ago used to black out and take his pants off”

Invest. Duh. If I ever get a fucking real job that offers a 401